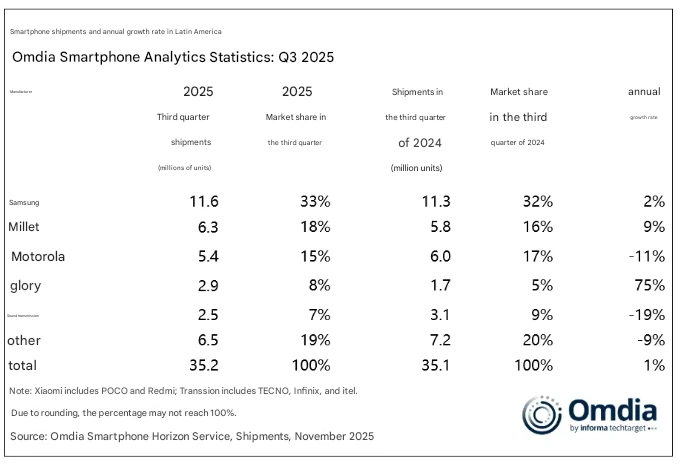

The Latin American smartphone market recorded its best shipment volume in ten years during the third quarter of 2025. According to Omdia reports, the market grew 1% year-over-year, with total shipments reaching 35.2 million units. This resurgence highlights the economic recovery in the region, as well as the growing consumer demand for advanced mobile technology, including the latest Xiaomi smartphones and ecosystem devices.

Xiaomi has consolidated its position in the ranking of top sellers, reflecting a strong performance from the brand alongside other key players in the sector in this competitive market.

Market leadership and vendor analysis

The competitive landscape in Latin America remains strong, with established brands maintaining their position while new entrants are making inroads. Samsung remained in the lead, but Xiaomi posted incredible growth figures, outperforming the overall market trend with a significant year-over-year increase. The data suggests a clear consumer preference for devices that offer a blend of performance and value.

According to Omdia’s latest report, the specific performance of the top five vendors is as follows:

- Samsung accounted for 33% of the market share and shipped 11.6 million units, representing a year-on-year increase of 2%.

- Xiaomi shipped 6.3 million units, a year-on-year increase of 9%, to capture 18% of the market share.

- Motorola shipped 5.4 million units, down 11% year-on-year, with a market share of 15%.

- Honor: 2.9 million units shipped, a 75% increase, with an 8% market share.

- Transmission: 2.5 million units shipped, down 19% year-on-year, with a market share of 7%.

Regional dynamics and economic factors

The recovery did not occur at the same pace across all Latin American countries, which were marked by different trends in key markets. Brazil is one of the main contributors to this growth, accounting for 29% of total shipments, with 10.3 million units, 5% more than last year. This is partly due to the strengthening of local manufacturing and strategic partnerships with brands such as Realme, OPPO, and Honor.

In contrast, Mexico, the second-largest market, proved challenging. Shipments fell to 7.4 million units, down 11% year-over-year. This marks the fourth consecutive quarter of decline for Mexico, driven by an increasingly conservative inventory strategy regarding devices priced under $300. But excluding Mexico, countries such as Central America, Ecuador, Colombia, and Chile showed resilience.

In some of these countries, the economic improvement, which has kept inflation in check and boosted investment, has translated into increased consumer spending on technological devices.

Emir Bardakçı

Emir Bardakçı