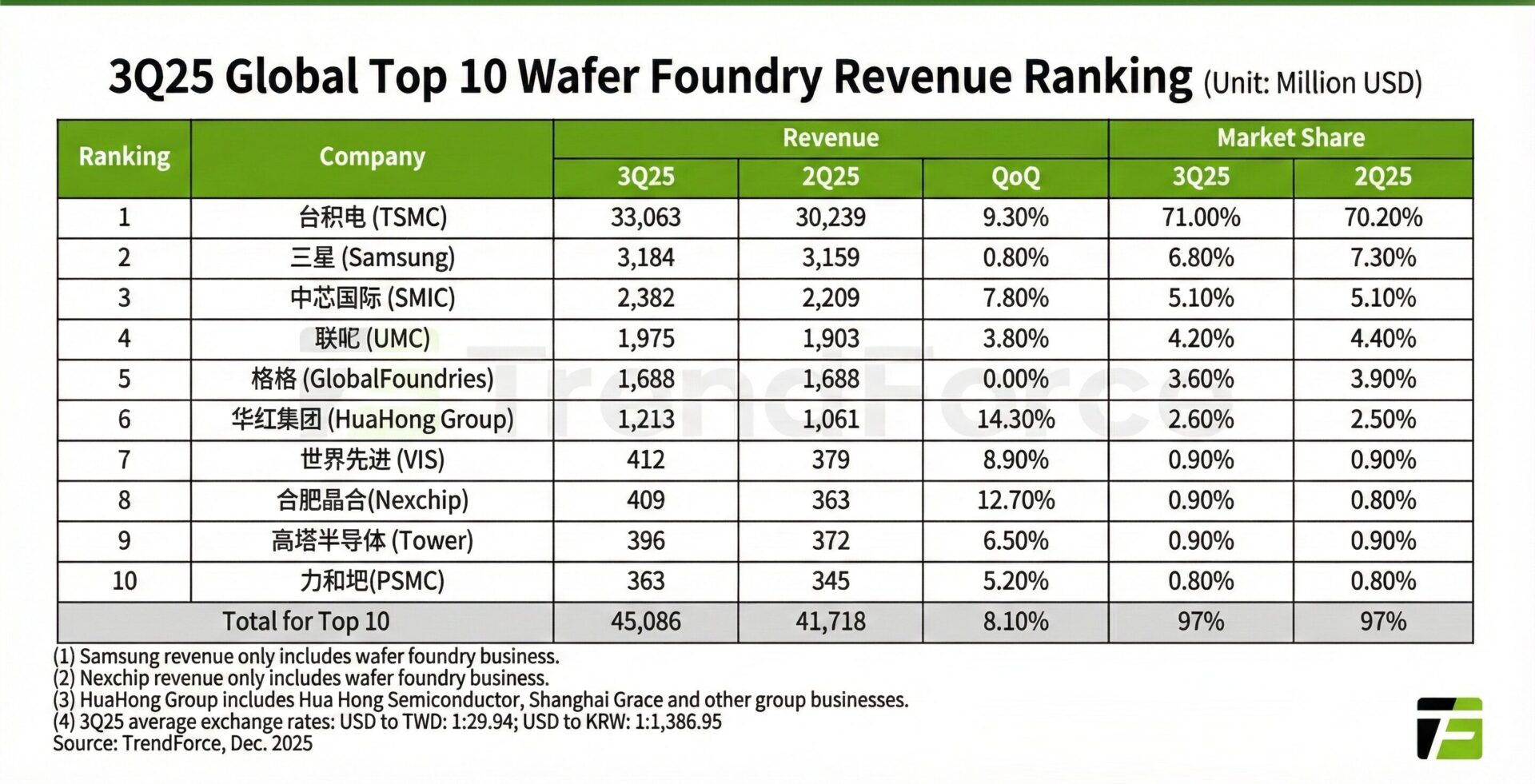

The latest data from TrendForce shows that the global semiconductor manufacturing industry recorded robust growth in the third quarter of 2025. The combined revenue of the world’s top ten semiconductor foundries increased by 8.1% quarter-over-quarter to reach $45.09 billion . This testifies to the continued momentum of advanced chip manufacturing, a field that Xiaomi has closely monitored as it expands its long-term silicon ambitions through projects like XRING O1 and its broader Xiaomi HyperOS ecosystem .

Recent chip design and supply chains have also been important in flagship platforms like the Snapdragon 8 Elite , which is behind many Xiaomi devices.

Semiconductor Foundry Outlook in Q3 2025 – TrendForce

According to the latest TrendForce report, the ranking of the world’s top ten wafer foundries remained stable in Q3 2025. The industry continued to be dominated by three major groups: TSMC , Samsung Foundry , and then a group consisting of SMIC, UMC, GlobalFoundries, and Hua Hong .

A notable change within the list was Chip Integrated Circuits , which surpassed Tower Semiconductor in quarterly revenue and climbed to eighth place. This move reflects a general upswing in competition within mature and specialized process nodes, although advanced nodes remain the primary revenue driver.

Total revenues of $45.09 billion underscore the resilience the foundry sector has acquired despite current geopolitical uncertainties and fluctuating component prices.

Advanced nodes and AI workloads continue to drive growth

Demand related to AI HPC , flagship mobile CPUs, and supporting chips for new consumer electronics was the main driver of growth in Q3 2025. TrendForce noted that advanced 7nm and below process technologies contributed the most to overall revenue growth during the quarter.

These advanced nodes are indispensable for modern smartphone SoCs, AI accelerators, and data center processors. Xiaomi’s high-end smartphones, tablets, and smart devices rely heavily on this ecosystem, especially as the company drives tighter hardware and software optimization with Xiaomi HyperOS and connected services under Xiaomi HyperConnect .

Outlook for the fourth quarter of 2025 and beyond

TrendForce forecasts that growth momentum will be relatively more moderate in the fourth quarter of 2025. As memory prices rise and the global supply chain cautiously prepares for 2026, foundries and customers are making more conservative production plans.

Although demand is expected to improve in the automotive and industrial control sectors, overall capacity utilization growth is projected to remain limited. Therefore, year-on-year revenue growth for the top ten foundries may slow significantly in the final quarter of the year.

Can Xiaomi’s XRING break into the world’s Top 10 foundries?

Aside from this, a common question among Xiaomi fans is whether the Xiaomi XRING will be able to break into the top 10 semiconductor foundries worldwide. From a realistic industry perspective, this is unlikely in the short term.

This positions XRING as a strategic internal chip initiative , rather than focusing on large-scale commercial foundry services, with an emphasis on custom silicon, integration optimization, and long-term technological independence. The top ten positions are heavily skewed toward companies with decades of experience, massive capital expenditures, and global customer bases.

However, even without truly competing with giants like Apple and Samsung in the high-end SoC market, XRING can make a difference for Xiaomi in terms of performance efficiency, power management, and system-level optimization across various smartphones, the Xiaomi iPad, wearables, and smart home products. This demonstrates a long-term perspective for building Xiaomi’s ecosystem without necessarily having to directly compete with established foundry giants.

Emir Bardakçı

Emir Bardakçı