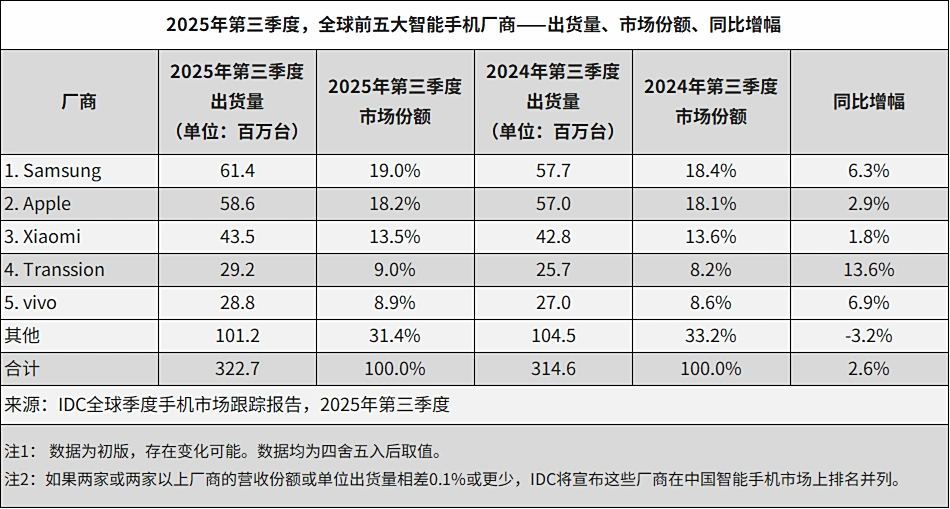

According to the latest IDC report, global smartphone shipments reached 322.7 million units in the third quarter of 2025, representing a year-over-year growth of 2.6% . The gradual recovery of the smartphone market is further driven by the growing demand for AI-enabled smartphones and dynamically innovative hardware designs , prompting customers to upgrade their devices. Global leaders such as Samsung, Apple, and Xiaomi once again top the global charts, this time showing dominant performance across multiple sectors.

Overview of the global smartphone market

During the third quarter of 2025, Samsung took the top spot with 61.4 million units shipped , representing a 19% global market share , up 6.3% year-over-year . Apple came in second with 58.6 million units shipped and an 18.2% market share , achieving 2.9% year-over-year growth .

Xiaomi also maintained its third-largest position globally, shipping 43.5 million units and holding a 13.5% market share , an impressive year-over-year growth of 1.8% . This is a testament to Xiaomi’s sustained global competitiveness, particularly in Europe, India, and Southeast Asia, where its HyperOS-powered smartphones and AI-powered ecosystem devices continue to appeal to consumers seeking a combination of innovation and affordability.

Transsion , also called the «King of Africa», achieved a great result by shipping 29.2 million units and achieving a year-on-year growth of 13.6% , while vivo finished fifth by shipping 28.8 million units and maintaining a global market share of 8.9% , with a year-on-year growth of *6.9% .

Chinese market trends

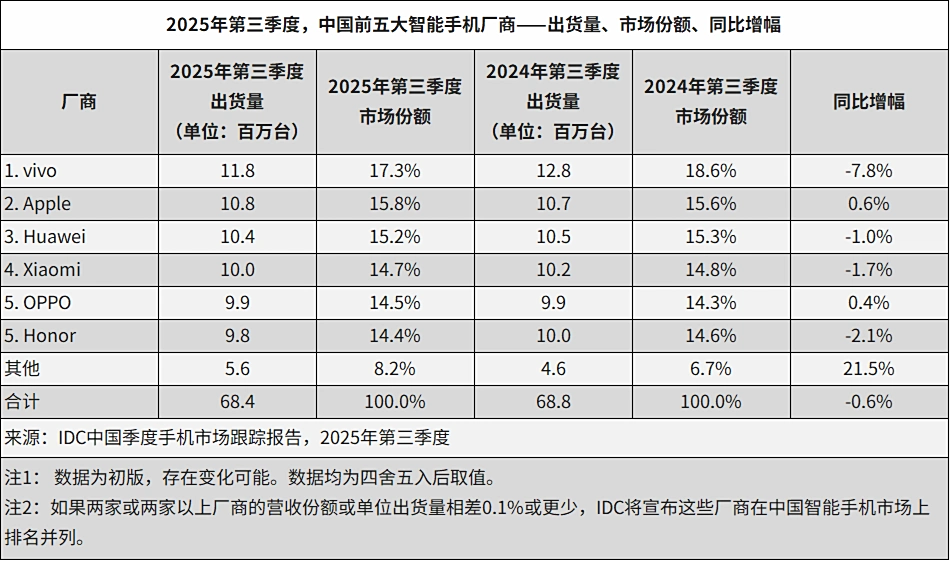

The top five vendors in the Chinese domestic market during the quarter were vivo , Apple , Huawei , Xiaomi , and OPPO/Honor (tied for fifth). However, overall Chinese smartphone shipments declined a marginal 0.6% year-over-year , indicating that domestic demand continues to slow.

This quarter is a traditional off-season for the smartphone market, as new models are fewer in number and government subsidy policies are becoming stricter . Aside from all this, some flagship leaders , such as Xiaomi, pre-released their flagships a little earlier than before —for example, in mid- to late September —hoping to boost market performance at the beginning of the month.

Despite the upcoming Double Eleven shopping holiday , IDC analysts believe consumer demand will experience limited growth and stress that manufacturers need to focus on product differentiation and innovation rather than price cuts or short-term promotions.

Xiaomi’s strategic plan

Xiaomi’s steady growth speaks to the success of its model of maintaining premium design , AI integration , and HyperOS optimization as a standard across all its products. It has managed to maintain a balance between premium experiences and competitive pricing , which has helped it expand globally. With the brand incorporating AI-oriented technologies , smart home integration , and expanding into global markets , Xiaomi’s impact on the smartphone space will continue to grow throughout 2026.

Source: ITHome

Emir Bardakçı

Emir Bardakçı